When navigating real estate transactions, the term “claim in title” can surface, often causing confusion and concern among buyers and sellers. Understanding what a claim in title entails is crucial for ensuring a smooth and legally sound property transfer. Let’s delve into the claim in title, its implications for property ownership, and how to address it effectively.

In real estate, a claim in the title refers to a legal assertion or encumbrance that affects the ownership or transferability of a property. This claim may arise due to various reasons, such as outstanding liens, unpaid debts, unresolved disputes, or legal challenges to the property’s ownership rights. It’s important to note that a claim in the title represents a potential obstacle or defect that can significantly impact the property’s marketability or ownership status, potentially leading to financial loss or legal complications. For example, if a property has a claim in the title, it may be difficult to sell or secure a loan against it, and the buyer may inherit the claim, leading to potential legal battles or financial obligations.

One common scenario where a claim in the title may arise is when a creditor places a lien on the property as collateral for an unpaid debt owed by the owner. This lien serves as a legal claim against the property’s title, giving the creditor the right to seek repayment through the sale of the property if the debt remains unpaid. Other examples of claims in the title include easements, which are rights to use a portion of the property, encroachments, which occur when a neighbor’s structure extends onto the property, boundary disputes, and competing ownership claims.

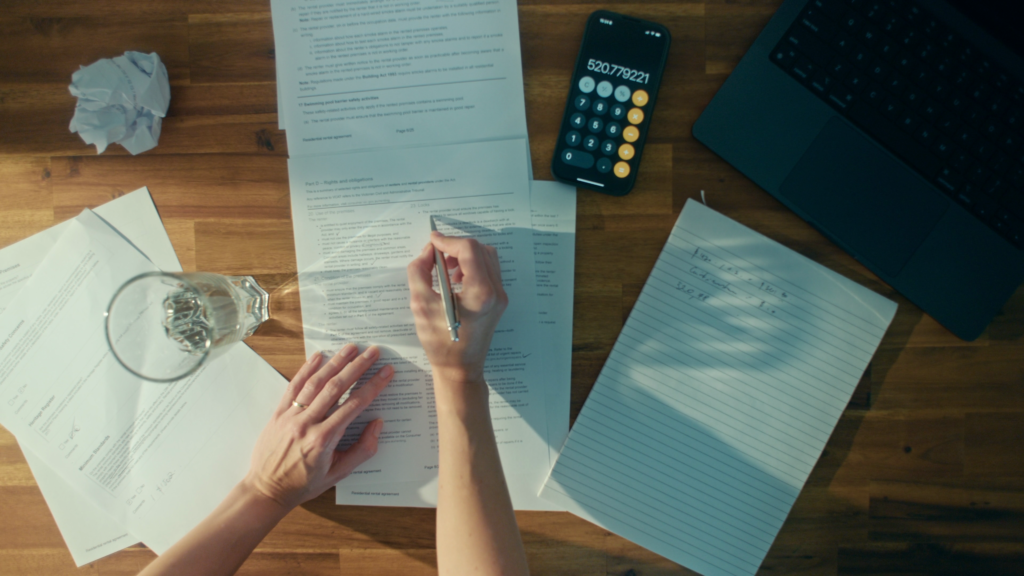

Addressing a claim in title requires careful investigation and resolution to ensure a clear and marketable title to the property. This investigation is part of the due diligence process, a comprehensive review of the property’s legal and financial status. It’s the responsibility of both buyers and sellers to conduct this thorough due diligence, including a comprehensive title search and examination, to identify any existing claims or encumbrances on the property’s title. This proactive approach can help avoid potential issues and ensure a smooth real estate transaction.

Suppose a claim in title is discovered during the due diligence process. In that case, the parties involved in the real estate transaction must take appropriate steps to address it before proceeding with the sale or transfer of the property. Depending on the nature and severity of the claim, resolution may involve:

- Negotiating with creditors.

- Obtaining releases or satisfactions of liens.

- Filing legal actions to quiet title.

- Seeking indemnification through title insurance.

Buyers and sellers must understand that resolving a claim in title may take time and [require the collective effort and cooperation from various parties involved]. Buyers should carefully evaluate the implications of any existing claims on the property’s title and consider their willingness to proceed with the transaction based on the outcome of the resolution process. On the other hand, sellers should take proactive measures to address any claims in the title before listing the property for sale to avoid delays or complications during the transaction.

In summary, a claim in the title represents a legal assertion or encumbrance that affects the ownership or transferability of a property. Buyers and sellers should conduct thorough due diligence to identify any existing claims in the title and take appropriate steps to address them before proceeding with a real estate transaction. By understanding the implications of claims in the title and working with experienced professionals, parties can [confidently ensure a smooth and legally sound property transfer].